Learn what a blockchain is in this simple 2026 guide. Discover how decentralized ledgers work, why they are secure, and how they power more than just Bitcoin.

By early 2026, the word “blockchain” has moved from the fringes of tech forums to the center of global infrastructure.

You might interact with it when you verify your digital ID, track a sustainable clothing brand back to its source, or trade digital assets.

Despite its fame, the technology remains a mystery to many. At its heart, a blockchain is simply a new way of storing and sharing information that does not require a central “boss” to keep things honest.

Think of it as a shared digital record book that everyone can see but no one can erase. In a world where deepfakes and data breaches are common, blockchain provides a “source of truth.”

This guide will explain exactly how these decentralized ledgers work plus why they are considered one of the most important inventions of the 21st century.

THE LEDGER CONCEPT: FROM PAPER TO DECENTRALIZATION

To understand a blockchain, you first need to understand a ledger. A ledger is just a list of transactions or records. For centuries, banks have used private ledgers to keep track of who has how much money.

If you send 50 dollars to a friend, the bank checks its private ledger, makes sure you have the funds, and updates the numbers. You have to trust that the bank is keeping accurate records and that their system is secure from hackers.

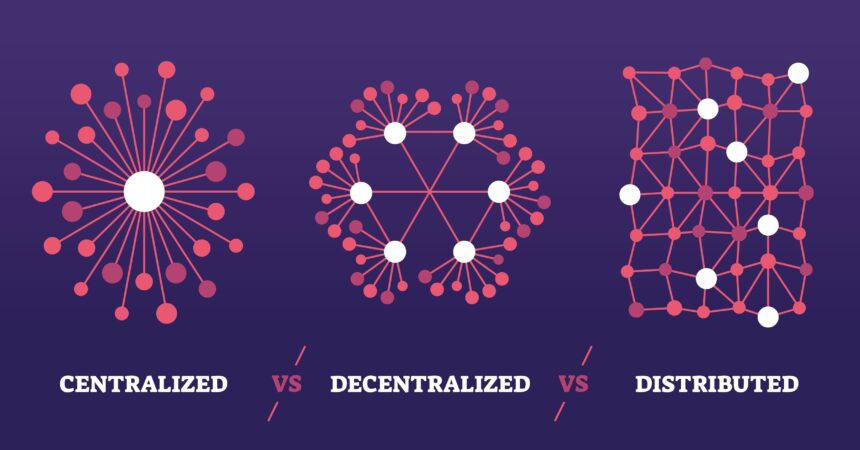

A blockchain turns this model upside down. Instead of one private ledger owned by a bank, a blockchain is a public ledger shared across thousands of computers simultaneously.

These computers are called “nodes.” Every time a new transaction happens, every node on the network updates its copy of the record book. This means there is no single point of failure and no single person in charge.

This is the essence of decentralization.

BLOCKS AND CHAINS: HOW THE STRUCTURE WORKS

The name “blockchain” tells you exactly how the data is organized. Information is grouped together into “blocks.” Once a block is full of data, it is closed and linked to the previous block.

This creates a chronological “chain” of information. In 2026, these blocks might contain financial transactions, medical records, or even legal contracts.

Each block contains three vital pieces of information:

- The Data: For example, the sender, the receiver, and the amount of a transaction.

- The Hash: Think of this as a digital fingerprint. It is a unique string of letters and numbers that represents the exact contents of that block.

- The Hash of the Previous Block: This is the “glue” that creates the chain. By including the fingerprint of the previous block, each new block is mathematically tied to everything that came before it.

THE POWER OF THE HASH

The hash is what makes the system secure. Because the hash is based on the contents of the block, changing even one tiny comma inside the data would completely change the hash.

If a hacker tries to edit a transaction in an old block, the hash of that block changes. Because the next block in the chain was looking for the old hash, the link breaks.

The rest of the network instantly recognizes that the chain has been tampered with and rejects the change.

CONSENSUS: HOW THE NETWORK AGREES ON THE TRUTH

If everyone has a copy of the ledger, how do they agree on which transactions are valid? This is done through a process called “consensus.”

Instead of a central authority deciding what is true, the nodes on the network follow a strict set of rules to reach an agreement.

In 2026, two main types of consensus dominate the landscape:

- Proof of Work: Computers compete to solve complex math problems to earn the right to add a new block. This is how the Bitcoin network stays secure. It requires a lot of “work,” which makes it incredibly expensive and difficult for a bad actor to cheat.

- Proof of Stake: Users “lock up” or stake their own tokens to participate in the process. This is the method used by Ethereum and many newer blockchains. It is much more energy efficient while still providing a high level of security through financial incentives.

WHY DOES BLOCKCHAIN MATTER? THE THREE PILLARS

The reason blockchain is revolutionary in 2026 boils down to three main benefits that traditional databases cannot match.

- Transparency: On a public blockchain, anyone with an internet connection can view the entire history of transactions. You can see exactly where a piece of data came from and where it went. This creates a level of accountability never seen before in finance or government.

- Immutability: “Immutable” means it cannot be changed. Once data is written to a blockchain and confirmed by the network, it is there forever. You don’t have to worry about a middleman “cooking the books” or accidentally deleting a record.

- Security: Because the data is spread across thousands of nodes, there is no central server for a hacker to attack. To change the ledger, a hacker would have to take control of more than half of all the computers on the network at the exact same time, which is practically impossible for major chains.

COMPARISON TABLE: TRADITIONAL VS. BLOCKCHAIN

| Feature | Traditional Database | Blockchain Ledger |

| Authority | Centralized (Bank/Gov) | Decentralized (The Network) |

| Trust Model | Trust the middleman | Trust the code and math |

| Transparency | Private and hidden | Public and verifiable |

| Editability | Records can be deleted | Records are permanent |

| Security | One point of failure | Distributed security |

REAL WORLD APPLICATIONS IN 2026

While many people still associate blockchain with Bitcoin, the technology has found dozens of “boring” but essential uses in the current year.

- Supply Chain Management: Companies like Walmart and Maersk use blockchain to track food and cargo. If a batch of spinach is found to be contaminated, they can trace it back to the specific farm in seconds rather than days.

- Digital Identity: Governments are starting to use blockchain for digital passports and driver’s licenses. This allows citizens to prove who they are without sharing all their private data with every app they use.

- Smart Contracts: These are self executing contracts where the terms are written directly into code. For example, a flight insurance policy could automatically pay out the moment a flight is canceled, without the customer ever having to file a claim.

- Real Estate: In 2026, we are seeing the “tokenization” of property. This allows people to buy a small fraction of a commercial building, making real estate investing accessible to everyone.

THE CHALLENGES AND THE FUTURE

Blockchain is not perfect. In early 2026, the industry is still working through challenges like “scalability.” Some blockchains can only handle a few transactions per second, which is too slow for global retail.

However, new “Layer 2” solutions and upgrades like the Ethereum Hegota phase are rapidly fixing these issues.

There is also the issue of regulation. As governments realize that blockchain is here to stay, they are creating new laws to protect consumers.

While this adds some complexity, most experts believe that clear rules will lead to even more adoption by big banks and traditional businesses. The goal is to keep the innovation of the technology while removing the “wild west” risks of the early days.

KEY TAKEAWAYS

- Shared Record: It is a digital ledger shared by a network of computers.

- No Middleman: It removes the need for banks or central authorities to verify data.

- Permanent: Once information is added, it cannot be changed or deleted.

- Transparent: Public chains allow anyone to audit the history of the ledger.

- Secure: The use of “hashes” and decentralization makes it nearly impossible to hack.

- Versatile: It powers everything from money and IDs to supply chains and legal contracts.

CONCLUSION

At its core, blockchain is a tool for building trust in a digital world. By using math and decentralized networks instead of central “gatekeepers,” it allows us to share value and information with more speed and security than ever before.

Whether you are an investor, a developer, or just a curious observer, understanding this foundation is essential for navigating the world of 2026.

The era of trusting a single entity with all our data is slowly coming to an end. In its place, we are building a more transparent and resilient internet.

While the technology will continue to evolve, the basic idea of a “chain of blocks” remains the bedrock of this new digital age.

FREQUENTLY ASKED QUESTIONS

- Is blockchain the same thing as Bitcoin?

- No. Bitcoin is a type of cryptocurrency that uses blockchain technology to function. You can think of blockchain as the “operating system” and Bitcoin as one “app” that runs on that system.

- Can anyone see my personal information on a blockchain?

- It depends on the type of blockchain. On public chains like Bitcoin, everyone can see the transaction amounts and wallet addresses, but those addresses are not directly linked to your real name. On “private” blockchains used by companies, only authorized people can see the data.

- Why is it so hard to hack a blockchain?

- To hack a major blockchain, you would need to change the data on more than 51 percent of all the computers in the network simultaneously. The cost of the electricity and hardware needed to do this is so high that it is cheaper to just play by the rules and earn rewards.

- What are “Gas Fees”?

- These are small payments made by users to compensate the network for the energy and computing power required to process a transaction. In 2026, these fees have dropped significantly due to new technical upgrades.

- Is blockchain bad for the environment?

- Newer blockchains like Ethereum use Proof of Stake, which uses 99 percent less energy than the old Proof of Work models. In 2026, most new projects are designed with environmental sustainability as a top priority.